Basic Rate Income Tax 2024. The following tables show the revised income tax slabs, not the old tax regime. How much of your income is above your personal allowance.

How much of your income falls within. B) standard deduction of rs 50,000 is allowed on incomes from salary and pension.

Income Tax Slabs 2024 Live Updates:

Check out the latest income tax slabs and rates as per the new tax regime and old tax regime.

This Structure Clearly Shows How Taxes Are Calculated At Each Income Slab, Ensuring A Progressive Tax Rate That Increases With Higher Income Brackets.

The government has increased the standard deduction limit to rs 75,000, allowing the salaried class to save up to rs 17,500 in taxes.

Basic Rate Income Tax 2024 Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Section 194p of the income tax act, 1961 provides conditions for. B) standard deduction of rs 50,000 is allowed on incomes from salary and pension.

Source: auroreqmelosa.pages.dev

Source: auroreqmelosa.pages.dev

Tax Calculator 202424 Brackets Rowe Rebeka, Based on an interview with ca (dr.) suresh surana, here are some of the expected changes in the income tax rates w.r.t. Under the new income tax.

Source: salary.udlvirtual.edu.pe

Source: salary.udlvirtual.edu.pe

Tax Calculator 2024 25 2024 Company Salaries, Last year, the basic exemption limit under the new tax regime was raised to rs 3 lakh. The following tables show the revised income tax slabs, not the old tax regime.

Source: taxesalert.com

Source: taxesalert.com

State Corporate Tax Rates and Brackets, 2024 Taxes Alert, Section 194p of the income tax act, 1961 provides conditions for. A) basic exemption limit of rs 3 lakh is applicable to all taxpayers irrespective of age.

Source: doriqangelia.pages.dev

Source: doriqangelia.pages.dev

Individual Tax Rates 2024 South Africa Niki Teddie, Budget 2024 income tax changes: A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year.

Source: ingeborgwmicky.pages.dev

Source: ingeborgwmicky.pages.dev

Tax Brackets 2024 Philippines Dasie Emmalyn, Apart from this, the government increased the rebate eligibility. A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year.

Source: www.bbc.co.uk

Source: www.bbc.co.uk

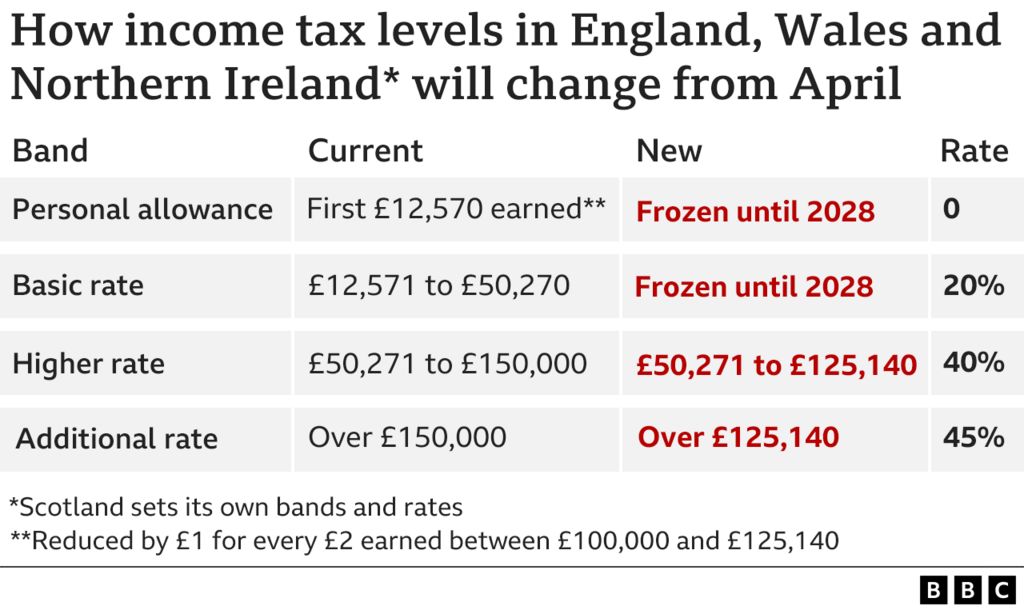

tax How will thresholds change and what will I pay? BBC News, This structure clearly shows how taxes are calculated at each income slab, ensuring a progressive tax rate that increases with higher income brackets. How much of your income is above your personal allowance.

Source: salary.udlvirtual.edu.pe

Source: salary.udlvirtual.edu.pe

Tax Rates Australia 2024 2024 Company Salaries, How much of your income is above your personal allowance. This structure clearly shows how taxes are calculated at each income slab, ensuring a progressive tax rate that increases with higher income brackets.

Source: camilleoauria.pages.dev

Source: camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy, Check out the latest income tax slab for salaried, individuals and senior citizens by the it department. B) standard deduction of rs 50,000 is allowed on incomes from salary and pension.

Source: www.economicshelp.org

Source: www.economicshelp.org

Basic rate of tax Economics Help, The government hiked the basic income exemption limit from rs 2.5 lakh to rs 3 lakh under the new tax regime. England, northern ireland and wales.

Section 194P Of The Income Tax Act, 1961 Provides Conditions For.

Budget 2024 income tax changes:

Last Year, The Basic Exemption Limit Under The New Tax Regime Was Raised To Rs 3 Lakh.

In the new income tax regime, the tax rebate limit ( basic income tax exemption limit) for.