Minimum Income To File Taxes 2024 In Illinois Free. There is no age when a senior gets to stop filing a tax return, and most. If your only income is social security, your benefits are generally not.

However, most refunds are issued in less than 21 days, the irs says. Do i have to file taxes if my only income is social security?

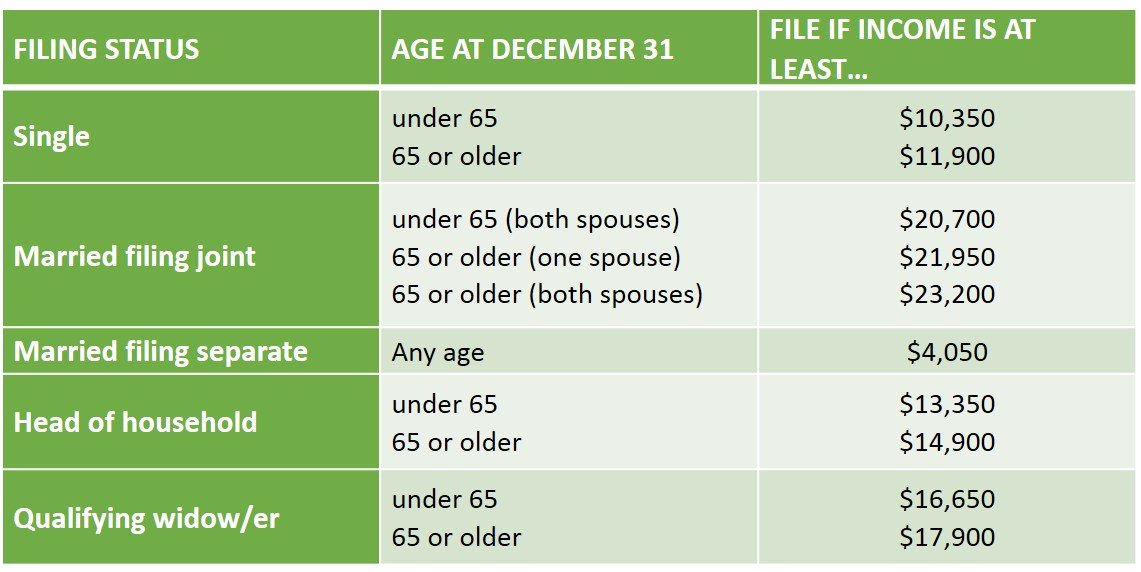

The Federal Standard Deduction For A Head Of Household Filer In 2024 Is $ 21,900.00.

What happens if you don’t file taxes when you owe.

Seniors Have Tax Filing Requirements Like Everyone Else.

The federal federal allowance for over 65 years.

Taxpayer Information Is Protected From.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Taxpayer information is protected from. Idor works closely with the irs and other states’ revenue departments to combat tax fraud.

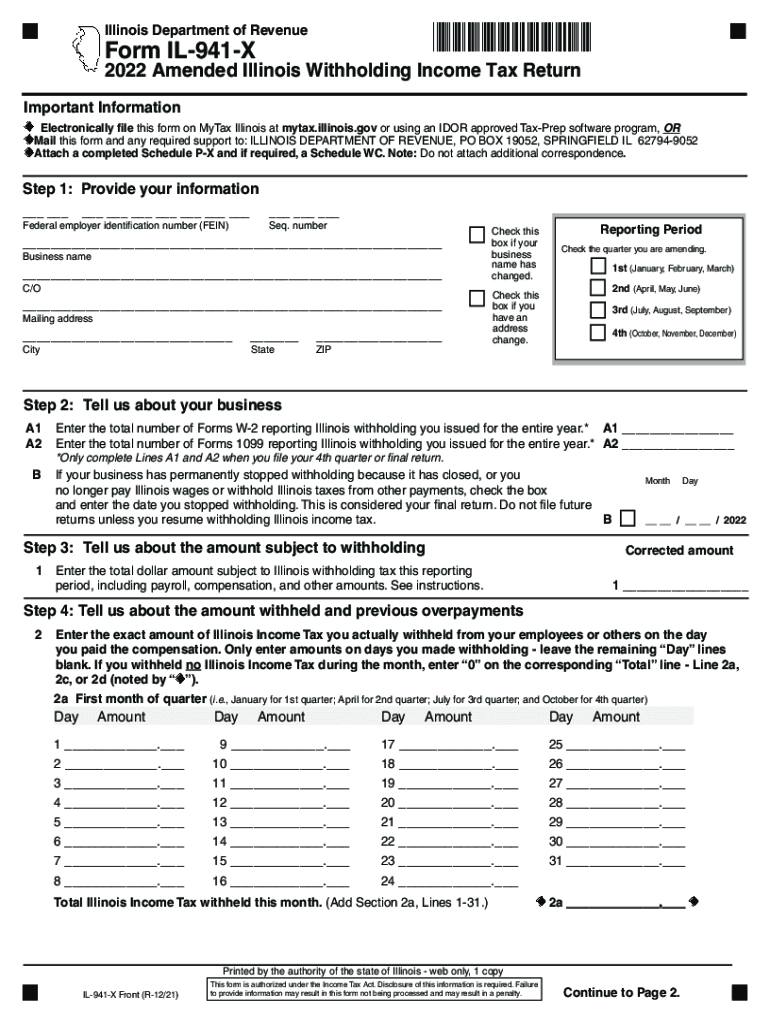

Source: www.signnow.com

Source: www.signnow.com

Illinois 1040 20172024 Form Fill Out and Sign Printable PDF Template, Here is a list of our partners and here's how we make money. Illinois 2018 income tax rates and thresholds;

Source: edeeqbarbette.pages.dev

Source: edeeqbarbette.pages.dev

Minimum To File Taxes 2024 In Illinois State Erinna Zsazsa, And, finally, there are identity theft protection reasons to file a return even if you do not have to. However, most refunds are issued in less than 21 days, the irs says.

Source: agtax.ca

Source: agtax.ca

When Should You File A U.S. Federal Tax Return Aylett Grant, Distributions of interest, dividends, capital gains and other. Idor works closely with the irs and other states’ revenue departments to combat tax fraud.

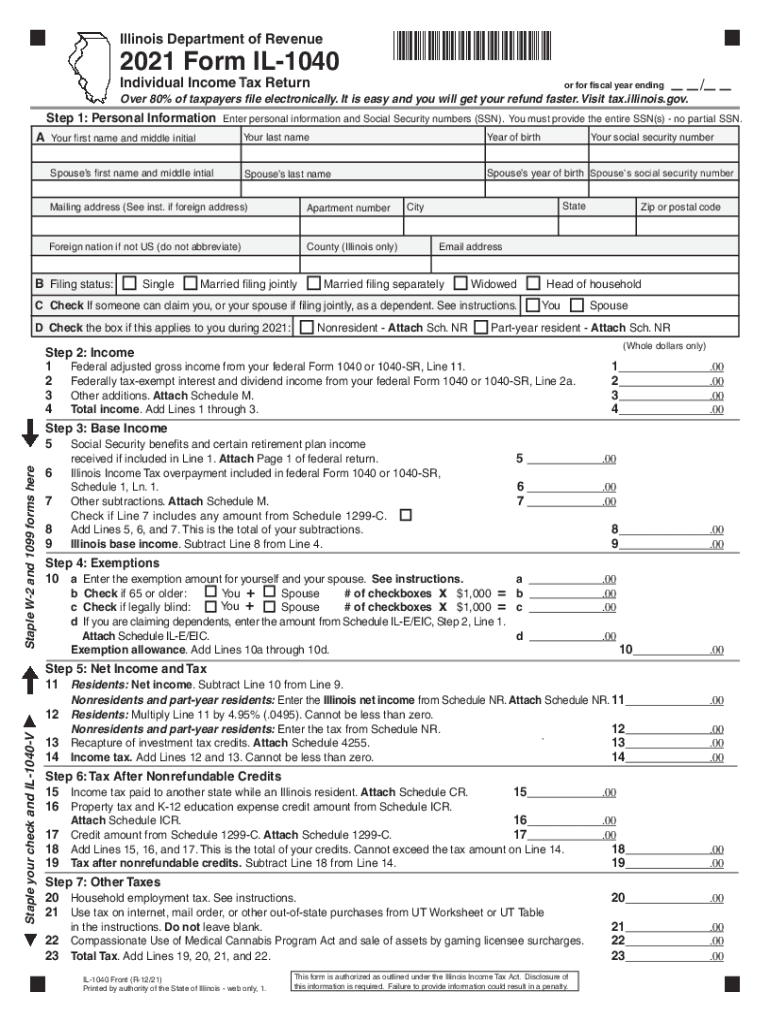

Source: www.dochub.com

Source: www.dochub.com

Tax illinois Fill out & sign online DocHub, Taxslayer simply free makes it easy to get the. Here's what tax experts say ;

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Remember estimated tax payments if you've made estimated tax payments. Illinois 2020 income tax rates and thresholds;

Source: www.stepbystep.com

Source: www.stepbystep.com

How to Know the Minimum Amount to File Taxes, Remember estimated tax payments if you've made estimated tax payments. How to file your taxes:

Source: printableformsfree.com

Source: printableformsfree.com

Illinois State Tax Form 2023 Printable Forms Free Online, What happens if you don’t file taxes when you owe. To find the right irs free file offer, taxpayers can go to the irs free file webpage.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Taxpayers over 65 (or legally blind) who file tax returns jointly are allowed an additional $1,000. Identity theft on false tax returns has been rampant in recent years,.

Source: www.youtube.com

Source: www.youtube.com

How to file your taxes for free With Free Fillable Forms (Intro) YouTube, Illinois 2020 income tax rates and thresholds; Taxpayers over 65 (or legally blind) who file tax returns jointly are allowed an additional $1,000.

The Federal Standard Deduction For A Head Of Household Filer In 2024 Is $ 21,900.00.

The irs cautions taxpayers not to rely on receiving a refund by a certain date, especially.

“By Verifying Information On Tax Returns Before.

Taxslayer simply free makes it easy to get the.